- 8 out of 10 Austrians know that 1/2/2014 is the conversion cut-off day

- One in four citizens knows their IBAN

- One in two Austrians transfers money via voucher – Tip: Transfer money using the Scan & Pay touch function

Austrians are well informed: 80 percent know that their account numbers and bank codes will be converted to IBAN and BIC on 1 February 2014. But the advantages associated with this – faster, safer, cheaper – are not as well known. One in four Austrians already knows their IBAN. With the Scan & Pay function, Erste Bank und Sparkassen is giving customers the option of transferring money with the touch of their fingertips.

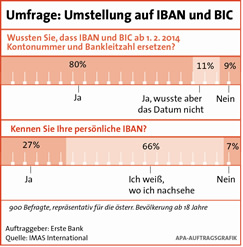

“The internationally valid account details are a big plus, because they make transfers faster, cheaper and safer,” says Jean-Yves Jacquelin, specialist in European SEPA payment transactions at Erste Bank. But only one in three Austrians is aware of these advantages. The detailed results of the IMAS survey commissioned by Erste Bank und Sparkassen are as follows: 55 percent of Austrians know that Euro transfers still take one working day within the EU. 44 percent have heard that the costs for international transfers are the same as domestic ones, while one third (34 percent) states that this prevents incorrect transfers. Word of the conversion cut-off day has got around. Eight in ten Austrians already know that account numbers and bank codes will be converted to IBAN and BIC on 1 February 2014. 11 percent had heard about it, but weren’t sure of the exact date, and 9 percent had no idea.

V článku najdete

One in four Austrians knows their IBAN

One in four Austrians knows their personal IBAN. Around two thirds of the population don’t, but say they know where they can find out about it. The clear majority of those unaware of their IBAN (47 percent) would initially look for their international account number on their ATM card, followed by their account statement (9 percent), their online banking portal (5 percent), or a bank clerk (3 percent). “The IBAN is unique. Don’t try and concoct it yourself; ask the bank or the payment recipient directly,” Jacquelin adds. The IBAN and BIC can be found on account statements, account/ATM cards, and in customers’ personal online banking portals.

Scan & Pay: Transferring money with the touch of a fingertip

Every second Austrian (53 percent) transfers money predominantly via voucher, e.g. using a payment form at the bank or using a self-service machine, followed by netbanking (35 percent). Telephone banking, mobile banking or EPS Online play a subordinate role, used only by 4 percent of the population. The potential for mobile banking is, however, great. Because Smartphone ownership in this country is rising dramatically – from 43 percent in 2011 to 61 percent in 2013. “It’s often tedious to fill out a payment transfer form – with the Scan & Pay function, we relieve customers of this burden,” says Jacquelin. Erste Bank und Sparkassen launched the Scan & Pay function as early as April 2013, allowing payment instructions to be simply scanned and transferred to netbanking. The Smartphone’s camera is used to read the entire payment form or a QR code marked on it, and automatically send the recipient data and payment amount to Netbanking. Self-service machines at Erste Bank branches can also record QR codes and forward them for processing. The QR code prevents any errors occurring when filling in the information.

Erste Bank und Sparkassen also offer an additional service: Standing orders and all templates stored in the netbanking facility are automatically converted to the recipient’s international account number by the Sparkassen Group, provided the recipient’s bank registers the IBAN. The customer doesn’t have to do anything here; the data is imported centrally. The account data conversion is set to be completed by mid-January. For business owners, Erste Bank offers an IBAN conversion service.

About the survey: IMAS International conducted telephone interviews asking 1,000 Austrians (representing a cross-section of the Austrian population aged over 14 years) what they knew about the conversion to IBAN and BIC, the advantages of IBANs, the personal account IBAN, and their preferred form of transfer. The interviews were conducted between 25 November and 7 December 2013.

Key IBAN and BIC data:

Every IBAN (International Bank Account Number) is unique worldwide, and contains clear information relating to the country, bank, institution and account number. An Austrian IBAN consists of 20 characters as follows: country code (AT for Austria), a two-digit check digit, the bank code, and the eleven-digit account number. For international transfers, the international bank code (BIC – Business Identifier Code) also needs to be listed until 1/2/2013.

Magazín LookCool s články, které vypadají skvěle! Magazín LookCool s články, které vypadají skvěle!

Magazín LookCool s články, které vypadají skvěle! Magazín LookCool s články, které vypadají skvěle!